One of a series of crucial fundamental lessons of trading of any kind is the importance of being disciplined. As a proposition, it is one that is frequently touted by the pros, and anyone involved in trading education will spout the mantra until their blue in the face. Sadly, many traders still end up learning this lesson the hard way, at the expense of their trading capital and, in some instances, their personal assets. Trading CFDs isn’t a game, and unless you like throwing your money down the drain it pays to listen to the lessons of those that have gone before you to avoid making these very same mistakes.

CFD Leverage and Discipline

Particularly with the unlimited liability of CFDs, maintaining discipline is a central component of keeping your capital in tact and building a profitable, sustainable trading portfolio. Entering trades too early, closing trades too late and getting greedy are all key signs of an undisciplined approach to trading, and they can often be the ruin of inexperienced, new traders, leading to exaggerated losses, under-performing positions and limited profits on the upsides. So too does discipline creep lead to the restraint of stops, and lingering over positions when better judgement and market data indicates strongly in the reverse direction.

Indiscipline can also be seen in traders who flip flop between strategies, and lack both the will power and the perseverance to see through their theories to fruition. Building up a nose for a trade takes time and experience, and it’s inevitable that many early trades will go wayward. Of course, even the most experienced traders in the world can get it horribly wrong – see the recent banking crisis as a prime example of this proposition in action.

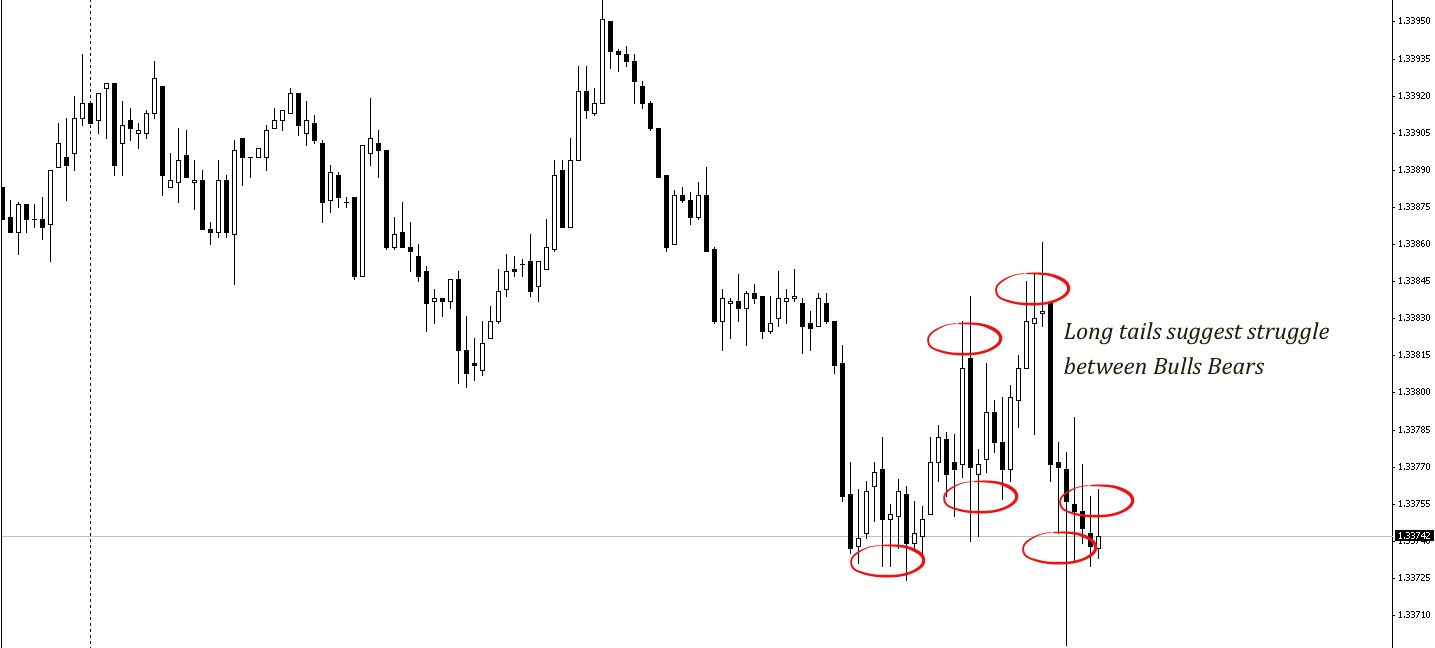

Maintaining a cool head and a rational approach to trading is key to entering the right positions and exiting at the optimum times. That means reading market analysis, interpreting the signs and abandoning your dearest held theories and principles when the going gets tough.

Example of Disciplined Trading

For example, with the collapse of Company X, many investors sought to buy shares after the first day’s highly negative trading, on little more than the gut feeling and instinct that the balance sheet was fundamentally sound. Unfortunately, market indicators and external factors were piling up against Company X to make it look far from investible, and those that lacked the discipline to stick to their trading guns and work within the parameters of their strategies bore the brunt of the total collapse in share price over the following few days.

Nothing should be allowed to guide your trading decisions other than cold, hard statistical evidence, and without recourse to the proper data it is impossible to operate on a consistent, rationed basis. While maintaining your discipline is seldom easy, it is critical to get yourself into the mindset of a professional trader and distance yourself sufficiently from gut feeling and hunch to invest on the basis of the evidence in front of you and the trading strategies which will serve you well over the long-term to avoid sustaining overly painful losses in the short term.

Swing Trading Benefits

Swing Trading Benefits