Contracts for difference are an attractive instrument for traders looking to diversify their portfolio on a number of counts, not least because they provide a degree of leverage to amplify the potential gains. But CFDs, like most tradable instruments carry their own disadvantages, and any proper consideration of the role of CFDs must pay due attention to the drawbacks and potential dangers associated with trading of this kind.

CFDs Are Risky and Leveraged

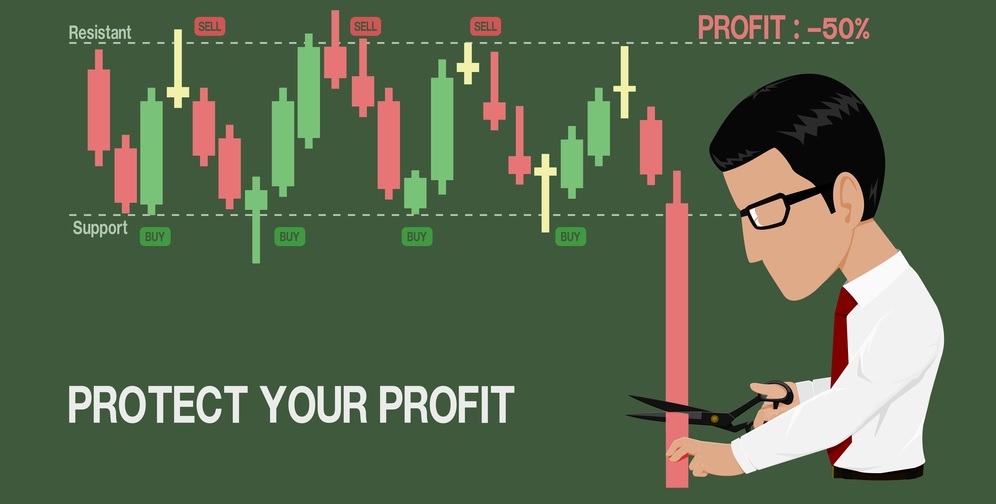

The primary and by far the most significant drawback with trading CFDs is the potential for significant losses beyond the initial contract value. Leverage can be a fantastic tool when the going is good, but it can have disastrous consequences when markets move against you, and it is often the ruin of inexperienced or overzealous traders. Remember that leveraged positions can go up and down, and that your entire deposit balance and more is vulnerable to the dreaded margin call.

When trading with margined products, it is essential to work with tight stops to prevent runaway positions wiping out your bank balance. While the upside gains are more than enticing, keeping a cool head and a realistic perspective on your trading is a vital component to minimising your losses and developing a longer-term, profitable and consistent trading strategy.

As a holder of CFDs, you also lose out on the rights associated with share holdings. This can be a disadvantage in respect of voting rights and having a say in how the company is managed, and you have no ownership in the underlying company itself – merely a contract relative to the index price of the security.

Factor In Dividend Payments

However, with CFDs you do benefit from dividend payments and other such corporate developments, albeit at a fractional rate compared with the share payout. It is therefore essential to make sure you factor in potential forthcoming dividend declarations, particularly when you’re going short, as this could have a bearing on the value of your CFD positions and consequently the degree of profit you’re able to draw from a particular transaction.

Furthermore, adopting significant long-term positions can be a costly business when trading CFDs, with commissions payable on the total transaction value and financing costs for the margined portion steadily increasing as time marches on. This is not necessarily disadvantageous, and the right position could easily wipe out the costs associated and still leave a healthy margin for profit. However, for less experienced traders or for positions with less volatility, these costs can at times become prohibitive to profitable trading, forcing the trader to look on a more short-term basis for his profits.

While this is undesirable for the trader, it performs a crucial role in limiting the exposure of the broker to risk, and thereby makes trading CFDs possible. Without the need for financing and comparatively large commissions, traders could notionally hang on to positions for decades and cash out on the natural upwards movements of the index, leaving brokers with a ticking time-bomb of contracts to be traded. By pricing this option largely out of viability, brokers can continue to offer CFDs as a trading instrument, and provide the added benefits of CFDs to a trading portfolio (albeit over a shorter-term period).

On the Bright Side – Advantages

CFDs can be a truly excellent add-on to your existing trading, and regardless of your strategy or trading style there are benefits to be had in including these instruments as part of your portfolio. That said, it remains of vital importance to fully understand the risks and the disadvantages of trading CFDs before your exposure becomes too deep, to minimise the potential for losses and ensure you’re in the best position to strategically build your investment portfolio.

More Risks of CFD Trading

Trading contracts for difference is a risky business by its very nature. The high returns that are up for grabs can only really come about with a corresponding high-risk profile, and for traders that dare to meddle with leverage, the penalties for getting it wrong can be harsh, swift and severe.

Aside from the risks of simple errors of judgement or ill fortune in trading CFDs, there are also a number of inherent risks in investing your capital which must be given due consideration. The successful trader should be able to recognize the diverse range of risks facing his portfolio, so that further risks can be minimised to reduce potential losses. But what do these risks look like, and what can they mean for your portfolio?

Market Risk

Every trader who has ever taken exposure in a market has faced market risk, and in many cases it has been a central contributing factor to the demise of successful traders. Market risk is the risk inherent in the market: that is, that the value of investing in the markets generally will fall, and investors will move their money into alternative markets. Over time, most traders assume that the markets will generally trend upwards. Market risk is the threat posed by markets drifting downwards, and is a factor that can externally act to depress the value of your trades and positions.

Liquidation Risk

For CFD traders in particular, the liquidation risk posed by exposure to the markets is significant and a constant factor to bear in mind throughout the duration of the trade. Liquidation risk is essentially the risk of a position or multiple positions across your account being liquidated at the demand of your broker in the event that you face a margin call for one or more of your trades.

A margin call is essentially a demand for a top-up to the margin requirement, which can come about as positions change in value. This risk of throttling profitable positions simply because of liquidity risk from other trades is one that requires careful financing planning to minimise. Know how much you’ve got invested, and know how much you’re likely to need in cash as a buffer to support your positions as they develop – this is critical to your success.

Counterparty Risk

Counterparty risk is the risk that arises from dealing with a third party for trading purposes. In most cases, the counterparty risk to CFD transactions will stem from the broker, who is of course the counterparty to the trade. What this risk essentially entails is the risk that the broker will default or become insolvent or be otherwise unable to honour its obligations. Naturally, this risk is minimised by choosing a reputable broker, but it is nevertheless a risk to bear in mind, and many traders spread their trading capital over different brokers to avoid being too heavily exposed to the counterparty risk of any one provider.

These inherent risks are shared by all CFD traders, but that’s not to say they should be overlooked. Understanding the threats to your trading capital is the first step in building in solid defences within your portfolio – critical for protecting your capital and weathering the storm for when markets inevitably periodically run against you.