When it comes to settling on a particular trading strategy, one of the most common that springs to mind is scalping. Scalping is the process of snatching quick profits from trades, often closing out early and moving on after a short period of time whenever the potential for a small profit presents itself. Applied to contracts for difference, scalping strategies can be particularly effective in delivering a steady stream of profits, but also difficult to execute with a few key barriers to easy profits.

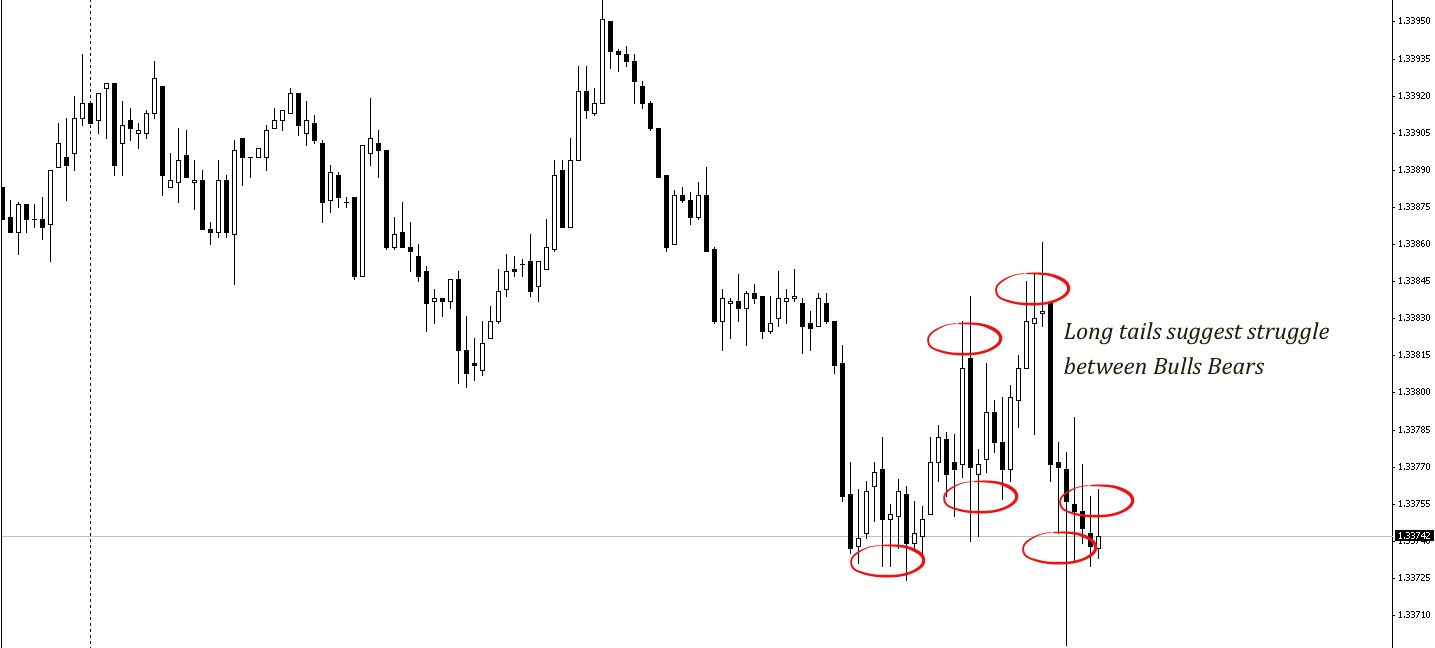

Example of Scalping

- Long tails suggest struggle between the bulls and the bears and thus market moves sideways presenting a great opportunities for scalping. Find short term support and resistance and trade of those levels as seen on the image above.

- Don’t ever try to scalp around important announcements which can cause big swings in either direction; it is better to wait for the quiet times when markets move sideways.

- Scalping and a very short term strategy, make sure you don’t use this strategy for a long term trading and make you apply “stop loss” order to keep potential losses in check.

Here’s a run down of the advantages and disadvantages of scalping strategy.

Scalping Benefits

- Leverage: the primary advantage of scalping with CFDs is the role of leverage, which acts as a buffer to bring larger profits from each trade. Because the scalp takes place over a very short period of time (often a mere matter of hours or even minutes), the margined nature of CFDs allows you to maximise earnings over the short space of time, with margin requirements of as little as 5% making generous gearing ratios possible.

- Low Financing Costs: when dealing with leverage and margin, the costs of borrowing can often stack up, particularly when positions are held overnight or for a matter of days. With a scalping strategy, you get the benefits of a leveraged position without the drawbacks of expensive financing costs, which can often eat considerably into the profit portion, simply by holding on to your leveraged portion for less time.

- Minimal Risk Exposure: the chances of losing too much over the course of a few scalping trades are minimal, and markets seldom move so violently as to cause any serious damage over such short periods of time. Likewise, by locking in profits when they arise, there’s very little chance of being in a position long enough for markets to correct and start to act against you.

Scalping Risks

- Limited profit potential: while scalping demands that you quickly lock in profits and close out transactions, this is often at the expense of more generous returns that come with time, and by limiting your positions arbitrarily you may be curbing your potential for taking a profit, which can be particularly hard to stomach when it later becomes apparent you’d backed a winner.

- Time-intensive: as trading strategies go, scalping is one of the most time consuming, relying on constant market engagement to make sure you’re taking profits when they show and cutting out at the right times. While broker orders can foot much of this responsibility, it’s still essential that you remain consistently on the lookout for your next scalp whilst also managing your current open positions.

- High transaction costs: because you are out to bank small profits wherever possible, the costs of transactions begin to look more significant, and automatically start you off on the wrong footing with each and every trade. Particularly given the higher transaction costs on leveraged positions, this can make scalping individual profits sufficient to exceed the applicable costs a tricky task.